The Startup Funding Landscape in India 2025

Startup Funding Options in India 2025: Are you an ambitious entrepreneur in India, looking to scale your startup in 2025? Well, you’ve just landed at the right place. You’re about to discover the top funding options for Indian startups in 2025 that could skyrocket your growth, increase your chances of success, and help you secure the capital needed to take your business to the next level. But let’s be real—getting funding in India isn’t as easy as sending a pitch deck to a few investors. It’s a jungle out there.

If you’re an entrepreneur or startup founder, you already know the drill. You have the idea, the hustle, and the vision to revolutionize your industry, but without cash, it’s all just a dream. The road to securing funding is littered with pitfalls, frustrating rejection emails, and endless hours of waiting. In 2025, startup funding options in India are evolving rapidly, with new avenues opening up for savvy founders who know where to look and how to pitch.

But here’s the truth: If you don’t know the ins and outs of India’s funding ecosystem, you could miss out on some of the best opportunities to fuel your startup. Whether you’re looking for government grants, tapping into the booming venture capital scene, or exploring alternative funding like revenue-based financing, there’s a funding option that fits every stage of your business.

So, who is this guide for?

This is for founders, entrepreneurs, and startup enthusiasts who want to break free from the endless hustle of chasing traditional funding routes and learn about the most lucrative, high-potential funding opportunities available in India right now. If you’re a business owner aiming to scale in 2025, you can’t afford to ignore these options.

In the next few sections, you’ll find an in-depth look at top funding options for Indian startups in 2025, from government initiatives that provide low-interest loans to high-risk, high-reward options like venture capital and angel investors. Along the way, we’ll break down how you can access each one, who they’re best suited for, and—most importantly—how you can secure them.

This guide isn’t just a fluff piece. It’s your blueprint to landing the funding you need and deserves to build the business you’ve always dreamed of. We’ll even give you access to the latest insights, tips, and tools that will position you as a top contender in India’s competitive funding ecosystem.

So if you’re ready to turn your startup into a unicorn 🚀, continue reading to unlock the secrets to securing funding and set your business on the fast track to success. 📈

Let’s dive in!👇

Section 1: Government Schemes – The Backbone of Startup Funding

When it comes to startup funding options in India 2025, you simply cannot ignore the robust government schemes that are specifically designed to support entrepreneurs like you. Whether you’re in the ideation phase or ready to scale, the Indian government has set up several schemes to give startups the financial push they need to succeed. These initiatives not only offer grants and loans but also provide invaluable support in the form of incubation, mentorship, and networking opportunities.

Let’s break down the key government-backed funding schemes that are making waves in the startup ecosystem.

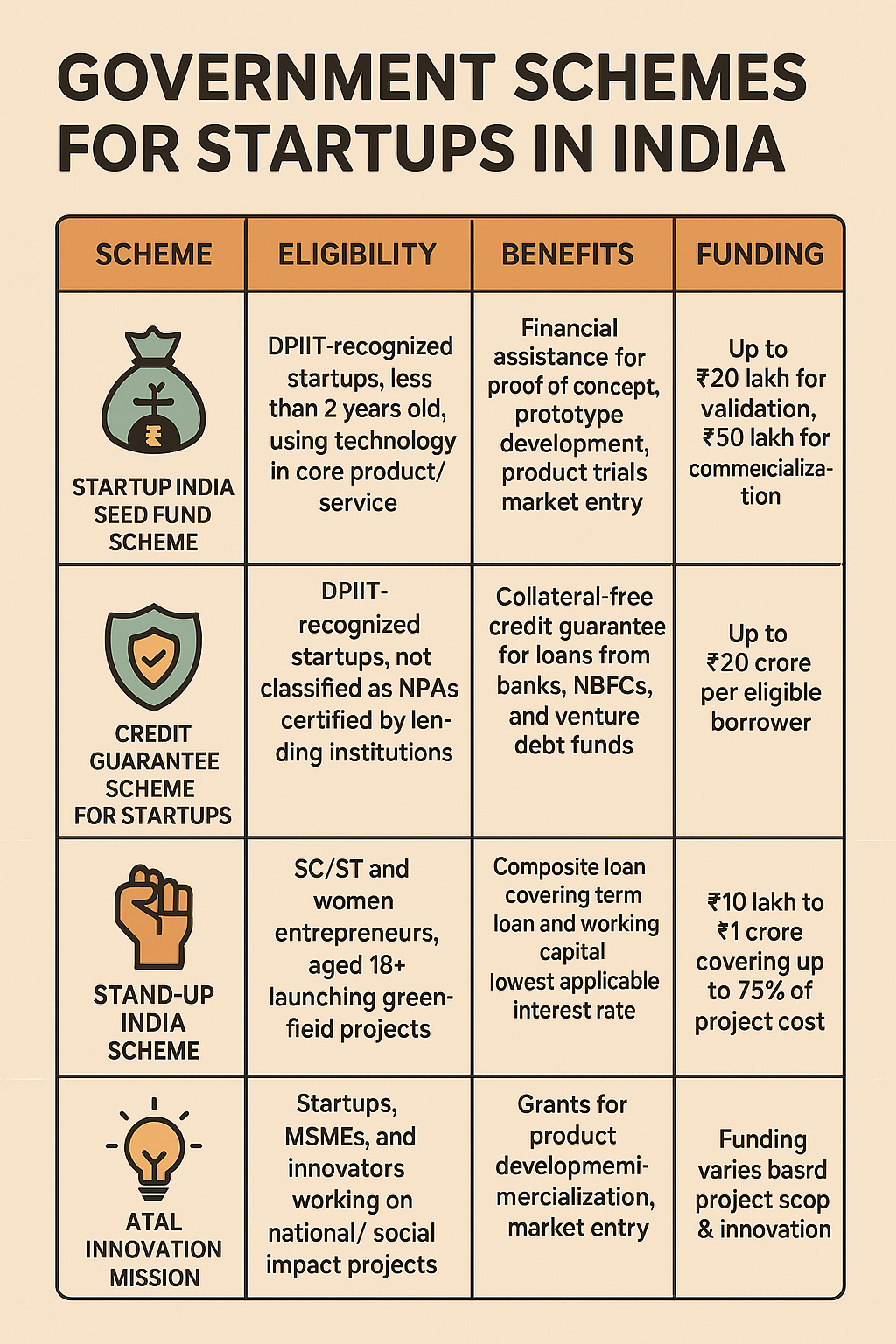

Startup India Seed Fund Scheme (SISFS):

This is the goldmine for startups in the early stages. Launched under the Startup India initiative, the Startup India Seed Fund Scheme (SISFS) offers financial assistance of up to ₹20 lakhs for product trials, market-entry strategies, and developing proof of concept.

For entrepreneurs who are still building their prototypes or testing ideas, this scheme is a game-changer. It’s a no-brainer for innovative startups that need that initial financial push to prove their concept. 🌱

👉 How to Apply: The application process is pretty straightforward, with the government seeking detailed proposals and a solid business plan. If you’ve got a groundbreaking idea, SISFS could provide the seed capital you need to take off. Learn more here.

Credit Guarantee Scheme for Startups (CGSS):

Debt funding might sound intimidating, but with the Credit Guarantee Scheme for Startups (CGSS), the Indian government is making it much easier for you to access capital without collateral. You can get loans of up to ₹20 crore under this scheme, which will help you with working capital, inventory, or any other financial need to grow your business.

What’s more? The scheme is designed to mitigate the risk for financial institutions by offering a guarantee for the loans disbursed to startups. This makes the process smoother and gives you access to funds faster. 💸

👉 Tip: Make sure you have your financials in order and a clear repayment plan in place. Explore CGSS here.

Stand-Up India Scheme:

In 2025, the Stand-Up India Scheme is making it easier for women entrepreneurs, as well as those from Scheduled Castes (SC) and Scheduled Tribes (ST) backgrounds, to break the funding barrier. Under this scheme, loans ranging from ₹10 lakh to ₹1 crore are available to eligible applicants.

This initiative aims to empower underrepresented groups and encourage them to become successful entrepreneurs. It’s a fantastic option for socially-conscious businesses that are targeting specific community needs.

👉 Tip: If you’re a woman or a member of the SC/ST community, this scheme could unlock doors to a huge financial opportunity. Read about Stand-Up India here.

Atal Innovation Mission (AIM):

The Atal Innovation Mission (AIM) is another critical initiative to support early-stage startups. If your focus is innovation and you are actively involved in creating disruptive solutions, this scheme is worth considering. AIM provides financial backing to incubators, accelerators, and innovation hubs, making it a great fit for tech-driven and high-impact startups.

It also gives you access to mentorship, training, and networking opportunities, which are critical when you’re trying to scale. AIM offers the perfect launchpad for game-changers in India. 💡

👉 Pro Tip: Startups engaged in science and technology or social entrepreneurship should make AIM a top priority. Discover more about AIM here.

Why Should You Care?

These government schemes are designed to reduce barriers to entry for aspiring entrepreneurs and provide them with the resources they need to build successful businesses. The beauty of these options is that they cater to a wide variety of needs: from proof of concept to working capital, these schemes cover it all.

As a startup founder, securing funding from government schemes could be one of the smartest moves you make in 2025. You don’t have to chase investors or risk giving away equity right off the bat. Leverage these schemes to secure the necessary capital and gain the credibility you need to unlock more funding opportunities in the future.

So, are you ready to take advantage of these opportunities and build the startup of your dreams? Let’s move on and explore venture capital and angel investors next, where even bigger funding opportunities await!

Section 2: Venture Capital – Fueling High-Growth Startups

If you’ve ever heard the phrase “high risk, high reward,” then you already know that venture capital (VC) is exactly that—high stakes funding with enormous potential returns. In the world of startup funding options in India 2025, venture capital is one of the most sought-after funding sources for those who have a scalable, high-potential business and are ready to make it big. But let’s not sugarcoat it: venture capitalists don’t just throw money around. They are looking for game-changing businesses that are going to transform industries. Is your startup one of them?

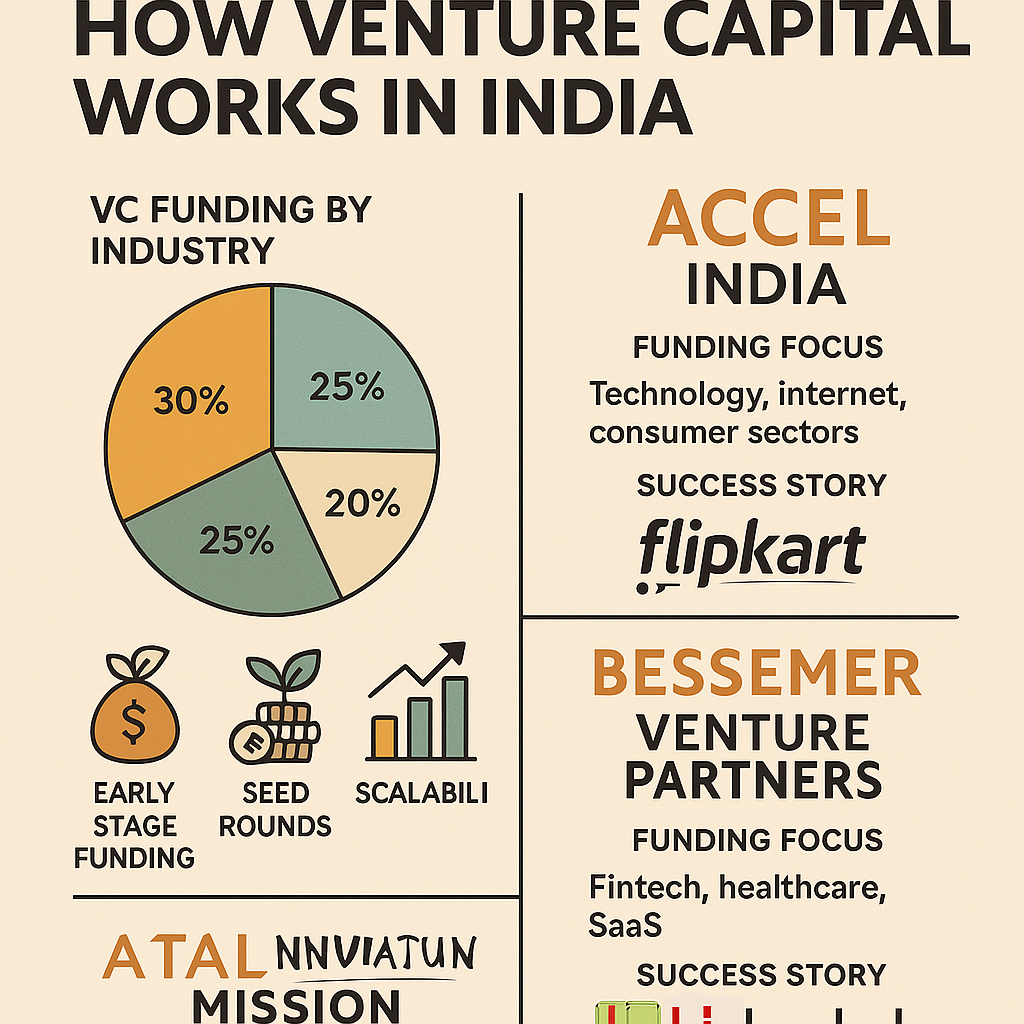

In 2025, India’s VC market is on fire! In fact, Indian tech startups raised a jaw-dropping $2.5 billion in Q1 2025 alone. Fintech, SaaS, and edtech companies are leading the charge, with VC firms eager to back the next big thing in these sectors. So, if your startup has the potential for explosive growth, then you could be the next big VC-funded success story. Here’s what you need to know.

Overview of Venture Capital in India

Venture capital in India is booming. Major cities like Bengaluru, Delhi, and Mumbai are becoming hotspots for investors, with venture capital firms looking to fund startups in technology, fintech, healthtech, and more. The Indian startup ecosystem has seen an influx of global players, making the competition fiercer than ever. But here’s the silver lining: VC firms are actively looking for high-growth startups to back.

India’s startup scene is growing at an exponential rate, and venture capital is a key driver of this growth. VC funding is typically structured as equity financing, where investors take a stake in your business in exchange for capital. As a founder, you get the funds you need to scale your operations, but in return, you give up a piece of your company.

Top VC Funds Active in 2025

If you want to secure venture capital investment, it’s crucial to know who the key players are. Here are some of the top venture capital funds that are making waves in India in 2025:

- Accel India: Accel is one of the most recognized VC firms in India, with over $650 million invested in early-stage companies. They have a proven track record of backing unicorns and high-growth startups across various sectors, including fintech, e-commerce, and SaaS. Accel has been involved in funding massive success stories like Swiggy, Flipkart, and Freshworks. 🚀

- Bessemer Venture Partners: With over $350 million under management, Bessemer focuses on early-stage investments in scalable businesses that have the potential to dominate their industries. This fund has backed companies like Freshworks and Pine Labs, both of which have become household names in the Indian startup ecosystem.

- Avendus Capital: Specializing in tech-driven businesses, Avendus Capital is another VC fund actively investing in Indian startups. With a focus on consumer tech, B2B, and fintech sectors, Avendus helps early-stage businesses scale quickly and effectively.

How to Attract VC Investment

Attracting venture capital is not easy. VC investors want to see potential for massive growth and a business that’s poised to disrupt an industry. To make your startup stand out, follow these steps:

- Scalability Is Key: VCs are interested in businesses that can scale quickly and dominate their markets. Your business model should demonstrate how you plan to grow rapidly and efficiently.

- Have a Strong Team: Investors want to back teams, not just ideas. Assemble a team of experts who are passionate about your mission and have the necessary skills to execute.

- Solid Business Model: Your business model should be clear, sustainable, and profitable. VCs want to see how you will make money and how you’ll reach profitability in the future.

- Disruptive Innovation: Are you solving a major problem in a new, innovative way? If your startup is doing something truly groundbreaking, investors will take notice.

- Networking and Pitching: Building relationships with VCs is just as important as having a great pitch. Get involved in startup events, pitch competitions, and industry conferences where investors are present. Networking is key to getting noticed.

👉 Pro Tip: Never underestimate the power of a compelling pitch deck. Your pitch is your first chance to impress investors—make sure it highlights the growth potential of your business, its unique value proposition, and how you plan to scale.

The Funding Process: What to Expect

The process of securing venture capital isn’t a sprint; it’s a marathon. VC firms typically follow a structured process:

- Initial Screening: They’ll look at your pitch and decide if your business fits their investment criteria.

- Due Diligence: If they’re interested, they’ll dive deep into your financials, market opportunity, team, and other key factors.

- Negotiation & Term Sheet: If everything checks out, they’ll present a term sheet outlining the terms of the investment.

- Fund Disbursement: Once the paperwork is done, funds are disbursed, and the real work begins.

The Benefits of Venture Capital

The benefits of securing VC investment go far beyond just the capital infusion:

- Expert Guidance & Mentorship: Most VCs don’t just throw money at you—they bring experience, guidance, and a network that can help you scale faster.

- Access to Networks: Venture capitalists are deeply embedded in the startup ecosystem. When you get VC funding, you also get access to their networks of potential customers, partners, and future investors.

- Brand Credibility: Having a reputable VC back your business adds significant credibility and can make it easier to attract more customers and future investors.

Why VC Is Right for You

If your startup is positioned for massive growth and you’re ready to scale, then venture capital is one of the best funding options available to you in 2025. Yes, it comes with its challenges, but the rewards—both financially and strategically—are worth the effort.

In the following sections, we’ll explore angel investors and alternative financing methods, which are often the next step for startups looking to diversify their funding sources.

But for now, take this moment to think about your startup’s growth potential. If you have a scalable idea that can disrupt the market, VC could be your ticket to the top. 🌍🚀

Section 3: Angel Investors – The Early Backers

If you’re a startup founder, you’ve probably heard the term angel investor tossed around. And let’s be honest: the idea of securing funding from someone who believes in you so much that they’re willing to put their personal wealth on the line can be incredibly exciting. Angel investors have been the unsung heroes of the Indian startup ecosystem, and in 2025, they’re still playing a critical role in helping founders like you get off the ground.

So, why should you care? Well, angel investors offer a unique opportunity: they can provide early-stage capital and mentorship when traditional sources of funding, like venture capital, are still a long way off. If your startup is in the seed stage and you need that first push to get going, angel investors might be exactly what you need. Let’s dive into how they work, where to find them, and how you can attract their interest.

Role of Angel Investors in India’s Startup Ecosystem

In 2025, angel investors are more critical than ever. They not only bring in early-stage capital, but they also offer something just as valuable: experience. These investors typically invest their own personal funds into your startup, often in exchange for equity. What sets angel investors apart from venture capitalists is that they are more likely to take risks on startups in the early stages, when the business model is still being refined and growth is uncertain.

What makes angel investors particularly powerful is their ability to provide hands-on mentorship and connect you to a larger network of resources, including potential customers, partners, and other investors. They know the ropes, and their guidance can be the difference between a startup that flounders and one that soars.

Notable Angel Networks in India

If you’re looking for angel investors in India, you’re in luck. India has some of the most prominent angel networks that have been responsible for the early-stage funding of successful startups, including Ola, Zomato, and Paytm. Below are a few of the most influential angel investor networks you should know:

- Indian Angel Network (IAN):

One of the largest angel networks in India, IAN boasts over 450 investors who actively support early-stage startups. They are highly involved in sectors like technology, consumer goods, and healthcare. IAN has a track record of successful exits, making them one of the most sought-after angel networks for startups in India. 👉 Pro Tip: Joining IAN could give you access to their wealth of resources, mentors, and funding opportunities. Learn more here. - Mumbai Angels:

Focused on tech-driven startups, Mumbai Angels is another major player in the Indian angel investor scene. This network has been instrumental in funding businesses across e-commerce, fintech, and enterprise software. If your startup is in the tech space, this is the perfect place to find an investor who not only has money but also knows the industry inside out. 👉 Tip: The network offers not only funding but also access to a wide range of business experts who can help you grow. Discover more here. - Chennai Angels:

Based in South India, Chennai Angels is another leading angel network with a strong focus on early-stage investments. They have a diverse portfolio that includes businesses in sectors like agriculture, education, and technology. If you’re in South India or have a business idea with potential for local impact, Chennai Angels might be your perfect fit. 👉 Pro Tip: Getting involved with Chennai Angels could open up doors for funding and collaboration, especially if your business targets regional markets. Explore more here.

How to Attract Angel Investors

While angel investors can offer you a significant amount of funding, don’t forget: they are also looking for significant potential in your startup. If you want to stand out and grab the attention of these investors, follow these tips:

- Craft a Winning Pitch Deck: Your pitch deck is your first and only chance to make a lasting impression. Investors are not interested in fluff. They want to see a clear problem you’re solving, a unique solution, a robust business model, and most importantly, scalability. Keep it concise but packed with impactful data.

- Demonstrate a Strong Team: Angel investors want to know that you have a dedicated, skilled team that can bring your vision to life. Make sure your team is not only talented but passionate about the mission of your startup.

- Show Traction: Whether it’s early sales, user growth, or positive feedback, traction is key. If you can demonstrate that your product has a market and that people are engaging with it, angel investors will take your business more seriously.

- Build Relationships: Networking is critical. Angel investors don’t just invest in ideas—they invest in people. Attend industry events, pitch competitions, and networking sessions where you can connect with potential angel investors. Having a personal connection can significantly improve your chances of getting funded.

- Have a Clear Exit Strategy: Angel investors want to see a clear path to exit, whether it’s through a future funding round, acquisition, or IPO. Show them that you’ve thought about how they’ll get a return on their investment.

The Advantages of Angel Investment

While venture capital may provide large sums of money, angel investors offer a more personalized form of investment. Here’s why this type of funding could be right for you:

- Personal Investment: Since angel investors typically invest their own money, they often take a personal interest in your success. This means you could have a mentor who’s invested in your growth beyond just financial backing.

- Smaller Investment, More Flexibility: While angel investors don’t always offer the huge sums that venture capitalists do, their funding can still be substantial enough to get your startup off the ground. Plus, the terms tend to be more flexible than those of VCs.

- Networking and Mentorship: Angel investors often bring a wealth of experience and connections that can be incredibly valuable in the early stages. They can help you navigate challenges, expand your reach, and scale your business more effectively.

Why Angel Investment Could Be Your Key to Success

In the early stages of your startup, angel investors offer a unique blend of capital and mentorship that can propel your business forward. If you’ve got a great idea and passionate team but lack the resources to move forward, angel investors might just be the boost you need.

In the next section, we’ll explore alternative financing methods like revenue-based financing and peer-to-peer lending, which offer different ways to raise capital without giving up equity. Stay tuned, because the funding game doesn’t end here!

Section 4: Alternative Financing – Beyond Traditional Methods

When you think about startup funding options in India 2025, your mind probably jumps to venture capital or angel investors. But here’s the deal: there’s a whole new world of alternative financing options out there that are quickly gaining traction. For startups looking for flexible, non-dilutive options, alternative financing might be the answer you’ve been searching for. These funding methods don’t require you to give up equity, and in some cases, you don’t even need a perfect credit history to qualify.

If you’re not ready to part with equity, or if your startup doesn’t fit the typical venture capital profile, then exploring alternative financing options could be the game-changer for you in 2025. These funding sources are growing in popularity, especially in the rapidly evolving Indian startup ecosystem. Let’s explore a few of the most exciting alternative financing options that could fuel your startup’s growth.

Revenue-Based Financing: A Non-Dilutive Option

If you’re a startup with consistent revenue, but you’re not yet at the point where you want to give away equity, then revenue-based financing might be the perfect fit for you. This type of financing allows you to raise capital by pledging a portion of your future revenues until the loan is paid back.

How does it work? In a typical revenue-based financing agreement, you receive capital upfront in exchange for a percentage of your monthly revenue until the loan amount (plus interest) is repaid. The beauty of this option is that it’s non-dilutive, meaning you don’t give up any equity in your company. Plus, payments are tied to your revenue, which means they scale with your business—if you make more money, you pay more; if you make less, you pay less.

This type of financing is becoming increasingly popular among growth-stage startups that are looking for flexible funding without giving up ownership. Platforms like GetVantage, Lendbox, and RevFin are leading the charge in India.

👉 Why It’s Ideal: If your startup has steady revenue but doesn’t want to give away equity or deal with the stringent requirements of traditional loans, this is the best option.

Peer-to-Peer (P2P) Lending: A Digital Twist on Traditional Lending

If you’re looking for a more personalized and flexible way to raise funds, then peer-to-peer (P2P) lending could be your solution. This is a financing model that connects borrowers directly with individual lenders, bypassing traditional financial institutions.

In India, platforms like LenDenClub, Faircent, and i2iFunding are revolutionizing the lending process by enabling businesses to borrow funds from individuals, who are often willing to lend at lower interest rates compared to banks or traditional financial institutions. P2P lending offers a more democratic way to access capital, with lower barriers to entry than conventional loans.

👉 How It Works: You’ll need to create a profile on a P2P lending platform and submit your business plan and financial data. Lenders then decide whether they want to invest in your business. The platform itself will usually assess your risk profile and set the interest rate.

👉 Why It’s Ideal: Startups with strong cash flow or those operating in niche markets can greatly benefit from P2P lending. It’s a great option if you need capital quickly without having to deal with the paperwork and bureaucracy of a bank loan.

Convertible Notes and SAFEs: Hybrid Instruments for Early-Stage Funding

For startups in the seed stage looking for quick and efficient ways to raise capital without having to value their company early on, convertible notes and SAFEs (Simple Agreements for Future Equity) have emerged as popular alternatives to traditional equity financing.

These instruments are essentially loans that convert into equity when the startup raises its next round of funding. They allow investors to put money into your startup early on, without setting a valuation for the company, which can often be difficult at the early stages. Convertible notes and SAFEs are advantageous for both the entrepreneur and the investor, because they reduce the complexity of negotiations and the hassle of valuation.

👉 How It Works: Investors provide you with capital now, and in exchange, they’ll receive equity in your company at a later funding round, typically at a discounted valuation or with a cap on the price. This allows them to share in the future upside of the company.

👉 Why It’s Ideal: Early-stage startups that are looking for funding but are hesitant to give up equity too soon will benefit from convertible notes or SAFEs. They give you time to grow your business and raise further rounds before having to commit to a valuation.

Crowdfunding: Mobilize Your Community

Crowdfunding has become a go-to alternative financing method for startups in India, particularly for those with a product or idea that has mass appeal. Platforms like Ketto, Wishberry, and Fueladream have made it easier than ever for entrepreneurs to raise money directly from the crowd.

With crowdfunding, you can reach out to individuals who believe in your product or service and ask them to support your business financially. In exchange, you often offer them rewards, early access to products, or equity in the company. Crowdfunding isn’t just about the money—it’s also about creating a community of supporters who are passionate about your business.

👉 Why It’s Ideal: If you have a consumer-facing product with mass appeal or want to test market demand, crowdfunding can be an excellent way to raise capital while simultaneously building a community of loyal supporters.

Why Alternative Financing is Worth Considering

If you’ve been looking for ways to raise funds without the stringent requirements of traditional bank loans or the complex negotiations involved in venture capital and angel investing, alternative financing options are your ticket to freedom. These methods are rapidly growing in India, and more and more startups are turning to them as a way to scale quickly without losing control.

Whether it’s through revenue-based financing, P2P lending, or crowdfunding, these options provide flexible, non-dilutive ways to raise capital, giving you more freedom to run your business on your terms.

In the next section, we’ll dive into corporate partnerships and strategic alliances, which can help you access capital and resources from established companies that share your vision. Ready to take the next step? Let’s keep moving!

Section 5: Corporate Partnerships and Strategic Alliances

As your startup continues to scale, you’ll soon realize that capital is just one piece of the puzzle. Yes, you need the funds to expand, but just as importantly, you need resources, mentorship, and networking opportunities. This is where corporate partnerships and strategic alliances come in.

In India’s startup ecosystem in 2025, aligning with established corporations can offer unmatched benefits: access to capital, resources, customer bases, and market credibility. Corporate partnerships can unlock doors to global markets, offer specialized know-how, and give your startup the kind of visibility that many entrepreneurs would dream of.

But let’s not sugarcoat things—getting a corporate partner isn’t as simple as signing a deal. You need to approach these partnerships with a clear strategy, value proposition, and long-term goals. So, how do you unlock the immense potential of these partnerships? Let’s break it down.

Collaborations with Established Corporates: A Game-Changer

One of the most effective ways to secure funding and resources is through collaborations with corporate giants. Think about it—what if you could tap into the vast resources of a well-established company while maintaining your startup’s autonomy? That’s the power of strategic alliances.

Big corporations in India, like Flipkart, Tata Group, and Reliance, are now actively investing in and partnering with startups. Why? Because they know that innovative startups are the future. These corporations are looking for startups that can complement their businesses, bring new technology or disruptive solutions, and help them maintain their edge in the market.

For example, in 2025, Flipkart secured RBI approval to offer direct lending, positioning itself as a corporate partner for startups that need access to capital. By partnering with Flipkart, you could potentially tap into their financial resources and their extensive customer base. Reliance has also been heavily involved in the startup scene, investing in everything from e-commerce to renewable energy.

How It Works:

- Access to Capital: Corporations often provide funding to startups as part of strategic partnerships, whether through direct investment, joint ventures, or even corporate accelerators.

- Resource Pooling: You’ll have access to their infrastructure, distribution networks, and technology, which can help you scale faster and more efficiently.

- Customer Base Expansion: Partnering with a large corporation gives you access to their established customer base, opening up new opportunities for growth and market expansion.

Benefits of Corporate Partnerships for Startups

The benefits of partnering with a corporate giant are enormous, and they can significantly impact your startup’s trajectory. Let’s explore these benefits:

- Financial Backing: Many large corporations now have venture arms or startup accelerators that offer seed funding, series A rounds, or corporate grants. These funds often come with fewer strings attached than traditional venture capital, making them an attractive option for entrepreneurs who want to retain control of their startups.

- Technology & Infrastructure: Startups often lack the resources to build out the sophisticated technology and infrastructure they need. Corporate partners can fill this gap by offering access to their existing infrastructure, technology platforms, and research and development capabilities.

- Strategic Guidance: Many corporate partners provide not only funding but also valuable business mentorship. Their vast experience in the market can help your startup navigate the challenges of scaling and growing.

- Market Penetration: Large companies can help you break into new markets and customer segments. Their established distribution networks and customer base can give your startup the kind of brand recognition that might otherwise take years to build on your own.

- Credibility Boost: A partnership with a corporate titan adds significant credibility to your startup. When Flipkart, Reliance, or Tata Group gets behind your business, potential customers, investors, and partners take you more seriously.

How to Forge Strategic Alliances

The key to securing a strategic corporate partnership is finding companies that align with your startup’s goals, values, and vision. Here’s how you can approach it:

- Identify Synergies: Look for companies that complement your business. If you’re in the tech space, for example, seek out corporates with a focus on innovation and digital transformation. If you’re in retail, look for companies that have a strong distribution network.

- Develop a Clear Value Proposition: When pitching to a corporate partner, you need to show them the value you bring to the table. What can you offer that they don’t already have? Are you offering innovative technology? Are you solving a problem they haven’t cracked yet? Make sure to articulate how the partnership benefits both parties.

- Leverage Industry Events and Pitch Competitions: Corporate partnerships are often formed through industry events, startup pitch competitions, and networking meetups. These events give you the opportunity to connect directly with potential partners.

- Build Relationships: Don’t just focus on the transactional aspect. Corporate partnerships are about long-term collaboration, so take the time to build genuine relationships with key decision-makers.

- Negotiate Terms: Once you’ve got their attention, it’s time to negotiate. Be clear about what you need—whether it’s funding, resources, or mentorship—and set clear terms for the partnership. Make sure both parties understand the expectations and contributions.

Real-Life Examples of Successful Corporate Partnerships

Let’s look at some successful corporate partnerships that have worked wonders for Indian startups:

- Ola and Tata Group: In 2025, Ola struck a deal with Tata Motors to build an electric vehicle fleet. This partnership helped Ola scale its electric ride-hailing service significantly while benefiting from Tata’s manufacturing capacity and market reach.

- Swiggy and Coca-Cola: Another notable example is Swiggy’s partnership with Coca-Cola, where Coca-Cola provided funding and marketing support for Swiggy’s growth in smaller towns and cities. This gave Swiggy the ability to tap into Coca-Cola’s vast distribution network and customer base.

- Reliance and Zomato: Reliance has invested heavily in Zomato through its retail arm. In return, Zomato has been able to scale operations and expand its footprint, with the backing of Reliance’s market reach and distribution channels.

Why Corporate Partnerships Are Essential for Your Startup

Corporate partnerships offer a unique blend of capital, expertise, and credibility that can fuel your startup’s growth in 2025. Strategic alliances are no longer just a luxury for unicorns—early-stage startups can leverage these partnerships to scale quickly, access resources, and make a real impact in the market.

As we move forward, the next section will explore the key factors investors consider when deciding whether to fund a startup, helping you prepare for future investment rounds. Ready to continue your funding journey? Let’s dive into that next! 🚀

Section 6: Preparing for Funding – What Investors Look For

If you’re actively seeking funding for your startup, you need to understand one critical thing: investors, whether they are venture capitalists, angel investors, or even corporate partners, are not just writing checks—they are making strategic decisions. They’re looking for high-potential businesses that align with their investment criteria. This means that preparing your startup for funding is just as important as finding the right investor.

In this section, we’ll break down the key factors investors look for in a startup and provide actionable steps you can take to make your business more attractive to potential investors. We’ll cover everything from scalability and team to business model and market opportunity, helping you position your startup to secure the capital you need to scale in 2025.

Key Factors Investors Consider

- Scalability: The Growth Potential Investors are not just interested in where your business is today—they want to know where it can go in the future. They are looking for startups that have the potential to grow exponentially and expand into new markets. If your business model can’t scale, investors will be reluctant to pour money into your venture. 📈 What You Can Do:

- Show a clear growth trajectory: Present your financial projections, customer growth rates, and market expansion strategy. This shows investors that you’re not just thinking about today but about long-term growth.

- Demonstrate product-market fit: Make sure you can prove that your product or service is not only in demand but that it can be delivered at scale.

- Team: The Heart of Your Startup No matter how great your idea is, investors know that a strong team is often the difference between success and failure. Your team should have a combination of skills—technical expertise, business acumen, and passion for the mission. Investors want to see a cohesive team with the right leadership in place to execute on your vision. 🔑 What You Can Do:

- Highlight key team members: Show off your team’s strengths, experience, and why they are uniquely qualified to execute your business model.

- Attract top talent: If your team is still small, now’s the time to attract the right people who can help you build the business and reassure investors that the right team is in place.

- Market Opportunity: The Size of the Prize Investors aren’t just betting on your product—they’re betting on the market. Is your product solving a real, large-scale problem? How big is the addressable market? Investors are interested in businesses that operate in growing industries with the potential to scale globally. 🌍 What You Can Do:

- Research your market thoroughly: Show the size of your target market, growth rates, and any relevant trends that suggest your product is well-positioned to succeed.

- Define your competitive advantage: Explain why your startup has a unique edge over competitors in the market and why it will become a dominant player.

- Business Model: How You Make Money A clear, sustainable business model is crucial. Investors want to know how your startup is going to generate revenue and become profitable. Whether you’re going for B2B, B2C, or a hybrid model, you need to clearly articulate how you will monetize your product and reach profitability. 💰 What You Can Do:

- Present a clear revenue model: Whether it’s subscription-based, transactional, or ad-based, investors want to see how you will generate reliable, recurring revenue.

- Show unit economics: Demonstrating that you can scale profitably—how much it costs to acquire a customer, the lifetime value of a customer, and your margins—will give investors confidence in your financial model.

- Traction: Proof That Your Idea Works Investors want to see that your business isn’t just an idea but that it has momentum. Whether it’s through early sales, user adoption, or partnerships, showing traction is a strong signal to investors that your startup has potential. Traction is the proof in the pudding, and it’s what turns ideas into investments. 📊 What You Can Do:

- Show growth metrics: Demonstrate customer growth, revenue milestones, and user engagement. If you have early adopters, show how they’re actively using your product or service.

- Customer feedback: Positive testimonials, case studies, or customer feedback can go a long way in showing that people are willing to pay for your solution.

- Business Plan and Financials: The Roadmap to Success Investors need to know how you plan to use their money. A well-thought-out business plan and financial projections are essential. They should outline your go-to-market strategy, marketing plans, sales tactics, and how you’ll allocate the funds once you raise capital. 📅 What You Can Do:

- Craft a detailed business plan: Outline your goals, roadmap, and how you plan to reach them. Make it data-driven and realistic.

- Prepare solid financials: Present clear profit and loss projections, cash flow statements, and balance sheets. Investors need to see that you understand your business’s financials and how you’ll manage their money.

Steps to Enhance Your Investment Readiness

- Perfect Your Pitch: Your pitch deck is often the first impression you’ll make with investors. Make sure it’s concise, compelling, and data-driven. Focus on the problem, solution, market opportunity, and growth potential.

- Get Your Financials in Order: Clean up your financial records and ensure they are transparent. Investors don’t want to wade through a mess of data—they want to see clear financial statements that are easy to understand.

- Build Relationships with Investors: Don’t wait until you’re ready to raise funds to start talking to investors. Network, attend startup events, and build relationships with potential investors early on.

- Seek Mentorship: Finding a mentor who’s successfully raised capital or scaled a startup can provide invaluable insights into what investors are looking for.

- Prepare for Due Diligence: When an investor shows interest, they will conduct due diligence to assess your business. Be prepared to provide all the relevant information about your financials, legal structure, team, and product.

Why Preparation is Key

Securing investment is not just about having a great idea—it’s about being prepared. Investors want to know that you’re serious, professional, and capable of executing your business plan. If you can show that your business is scalable, has a strong team, and is solving a real problem in a large market, you’ll be well on your way to attracting the funding you need to take your startup to the next level.

In the next section, we’ll take a look at the challenges that Indian startups face when securing funding and how you can navigate those obstacles successfully. Let’s dive into the realities of the startup funding world. 🚀

Section 7: Challenges in the Funding Ecosystem

Securing funding for your startup is never a walk in the park—especially in a dynamic and competitive ecosystem like India’s. While there are numerous startup funding options in India 2025, navigating the funding landscape is not without its challenges. From global economic factors to local regulations and the ever-changing investor landscape, startups face numerous hurdles when trying to raise capital.

In this section, we’ll explore some of the key challenges Indian startups face when seeking funding and provide actionable insights into how you can overcome these obstacles to secure the capital you need to grow.

1. The Funding Winter – The Global Slowdown

It’s no secret that in 2025, the global venture capital market is facing a funding winter, a term used to describe a slowdown in investments. This is a trend that has affected many startup ecosystems worldwide, and India’s startup funding is no exception. With a global recession looming, many venture capitalists are becoming more cautious and risk-averse. As a result, funding rounds are taking longer, and investors are more selective in where they place their bets.

This slowdown has made it more difficult for early-stage startups to secure funding, and seed-stage rounds are particularly hard-hit.

📉 What You Can Do:

- Be strategic with your funding goals: If venture capital is drying up, consider turning to alternative funding methods such as revenue-based financing or government schemes to bridge the gap.

- Focus on sustainable growth: Rather than aiming for massive growth, focus on building a sustainable business with a clear path to profitability. Investors in a funding winter are looking for businesses that can survive tough times.

2. Regulatory Hurdles and Compliance Issues

India’s regulatory environment can often be a maze for startups, especially when it comes to raising capital. The government has made great strides in encouraging entrepreneurship with initiatives like Startup India, but compliance requirements can still be complex and cumbersome.

From taxation laws to foreign investment regulations, navigating the legal landscape can be time-consuming and confusing. These regulatory hurdles often delay the funding process and make it more difficult for startups to raise money quickly.

⚖️ What You Can Do:

- Consult with legal experts: Make sure your startup is compliant with all relevant laws and regulations. Hire a lawyer or consultant who understands the legal intricacies of the Indian startup ecosystem.

- Leverage government support: Initiatives like Startup India and the Credit Guarantee Scheme for Startups are designed to help you navigate compliance hurdles and make fundraising easier.

3. Limited Access to Domestic Capital

While the Indian startup ecosystem has grown immensely in recent years, one of the most significant challenges is the limited access to domestic capital. Much of the funding for Indian startups has historically come from foreign investors, but in 2025, domestic funding options are still relatively underdeveloped. As a result, many startups are heavily reliant on foreign venture capital or corporate investors.

The absence of a robust domestic funding infrastructure makes it more difficult for early-stage startups to raise funds locally, especially when global capital flows are drying up.

💡 What You Can Do:

- Seek out local angel investors and networks: Networks like Indian Angel Network and Mumbai Angels are working to change the funding landscape. Get involved in local angel investment communities to attract domestic capital.

- Look for government-backed funding: Take advantage of government schemes that provide seed capital and loans with fewer strings attached, such as the Startup India Seed Fund Scheme (SISFS) or the Stand-Up India Scheme.

4. Intense Competition for Investor Attention

India’s startup ecosystem is booming, and that means competition for investor attention is fiercer than ever. With thousands of startups vying for limited funding, it’s not easy to stand out. Many investors are bombarded with hundreds of pitch decks each week, making it hard for even the most innovative startups to get noticed.

With the rise of digital platforms and crowdfunding, it’s easier than ever to find funding options. But at the same time, it has also increased competition and made it more difficult for startups to secure investments.

🏅 What You Can Do:

- Perfect your pitch: Don’t just rely on generic pitch decks. Make sure your pitch is compelling, unique, and tailored to the specific investors you’re targeting. Understand their investment preferences and align your pitch accordingly.

- Build a personal network: Investors are more likely to invest in startups they know. Attend networking events, pitch competitions, and other opportunities where you can personally meet potential investors.

- Leverage social proof: Demonstrate your traction and market fit by showcasing customer testimonials, user numbers, or partnerships that validate your business model.

5. Valuation Challenges in Early-Stage Startups

Setting an appropriate valuation for your startup can be incredibly tricky, especially in the early stages. In 2025, many early-stage startups are overvalued, and this can make it difficult to attract the right kind of investors. Venture capitalists are often hesitant to invest in startups with inflated valuations, as they want to ensure they’re getting a good deal.

On the other hand, undervaluing your startup can also be detrimental, as you might risk giving up too much equity too soon, potentially diluting your ownership and control over time.

💼 What You Can Do:

- Use a realistic valuation: Focus on setting a valuation that aligns with your current traction, market opportunity, and revenue projections. Avoid overestimating your startup’s worth.

- Seek feedback from experienced investors: Engage with mentors and investors to get a second opinion on your valuation. This will help you strike a balance between giving up equity and attracting investors.

How to Overcome These Challenges

Navigating these funding challenges may seem daunting, but there are actionable steps you can take to overcome them:

- Diversify Your Funding Sources: Don’t rely on one source of capital. Mix government schemes, angel investors, VCs, and alternative funding options to build a diversified funding strategy.

- Focus on Traction: Investors are most interested in businesses that have traction—whether it’s users, sales, or partnerships. The more you can prove that your product is market-ready, the more attractive you’ll be to investors.

- Stay Adaptable: The funding landscape is always changing, so stay agile. Adapt your business model, funding strategy, and growth plans to keep pace with evolving market conditions.

Conclusion: The Road Ahead

Securing funding for your startup in India in 2025 will undoubtedly have its challenges, but it’s not impossible. With the right preparation, a solid strategy, and a bit of perseverance, you can navigate the hurdles and unlock the capital you need to scale.

As you continue your funding journey, remember that the startup ecosystem in India is vibrant and full of opportunities. Whether you’re exploring government schemes, angel investors, venture capital, or alternative financing, there’s a path forward for every entrepreneur.

So, are you ready to turn your startup dreams into reality? The time is now—get the funding you need, and let’s build the future of India’s startup ecosystem! 🚀

FAQs

As we’ve covered a lot of ground on startup funding options in India 2025, you may have some lingering questions. Don’t worry, we’ve got you covered! Here are some of the most frequently asked questions (FAQs) about securing funding for your startup in India.

1. What are the best funding options for Indian startups in 2025?

In 2025, Indian startups have access to a variety of funding sources, including:

- Government schemes like the Startup India Seed Fund Scheme and Credit Guarantee Scheme for Startups.

- Venture capital funds such as Accel India, Bessemer Venture Partners, and Avendus Capital.

- Angel investors through networks like Indian Angel Network and Mumbai Angels.

- Alternative financing options like revenue-based financing and peer-to-peer lending.

- Corporate partnerships with large companies like Reliance, Flipkart, and Tata Group.

Each of these options offers unique benefits depending on the stage and nature of your startup.

2. How can I attract venture capital investment for my startup?

Attracting venture capital investment requires a compelling business model, growth potential, and a strong team. Here’s what to focus on:

- Scalability: Show that your business can grow rapidly and scale efficiently.

- Traction: Demonstrate proof of concept, user growth, or revenue.

- Strong team: Investors want to see a team capable of executing the business plan.

- Clear exit strategy: Investors are looking for a profitable exit, whether through acquisition, IPO, or future funding rounds.

Craft a powerful pitch that highlights these aspects to grab the attention of venture capitalists.

3. What is revenue-based financing, and is it a good option for my startup?

Revenue-based financing allows startups to raise funds based on future revenue projections. Instead of giving up equity, you agree to pay back the loan with a percentage of your monthly revenue until the loan and interest are repaid. This option is non-dilutive, making it attractive for founders who want to maintain control of their business. It’s a great option if you have consistent revenue but aren’t ready for traditional equity financing.

4. How do I prepare my startup for investment?

Preparing your startup for investment involves:

- Building a strong team: Investors look for teams with a mix of skills, passion, and experience.

- Having a scalable business model: Investors need to see that your business has the potential to grow rapidly.

- Demonstrating traction: Show early success through customer acquisition, sales, or user engagement.

- Creating a clear business plan and financials: Outline your path to profitability and how you will use the investment to scale.

Make sure your pitch deck is concise and data-driven, and your financials are in order.

5. What are the biggest challenges in raising funds for a startup in India?

Some common challenges include:

- Funding winter: The global slowdown in investments has made venture capital more difficult to secure.

- Regulatory hurdles: Compliance with local laws can be complex and delay funding processes.

- Limited access to domestic capital: Many Indian startups still depend on foreign investors for funding.

- Intense competition: With thousands of startups vying for funding, standing out from the crowd can be tough.

- Valuation challenges: Setting a realistic valuation for early-stage startups can be tricky.

To overcome these challenges, diversify your funding sources, focus on traction, and adapt to the changing market conditions.

6. Can I raise funds from angel investors?

Yes, raising funds from angel investors is a great option, especially in the early stages. Angel investors provide seed capital in exchange for equity and are often willing to take more risks than venture capitalists. They also bring expertise, guidance, and networks that can help you grow. Look for reputable networks like Indian Angel Network and Mumbai Angels, which have a track record of investing in successful startups.

7. How do corporate partnerships work for startups?

Corporate partnerships can provide funding, resources, and market access for startups. Corporates like Reliance, Flipkart, and Tata Group are actively investing in startups and offering partnerships that help startups scale quickly. These partnerships can include:

- Financial backing in the form of direct investments or joint ventures.

- Access to technology, infrastructure, and distribution networks.

- Customer base expansion, providing a faster route to market.

- Credibility boost, as partnering with a major corporation adds trust to your brand.

To secure a corporate partnership, ensure that your business aligns with the corporation’s goals and that you offer unique value.

8. How do I find the right investor for my startup?

Finding the right investor is about matching your needs with the investor’s preferences. Start by researching investors who have experience in your industry and are aligned with your growth stage. Venture capitalists are suitable for high-growth startups, while angel investors might be better suited for early-stage companies. Corporate partnerships can also be a good choice if you’re looking for strategic backing beyond just money.

Make sure your pitch speaks directly to the investor’s goals and interests. Networking at startup events, pitch competitions, and industry conferences can also help you find investors who are genuinely interested in your business.

9. What are the advantages of crowdfunding for my startup?

Crowdfunding offers several benefits:

- Non-dilutive: You don’t have to give up equity in your business.

- Market validation: Crowdfunding can act as a proof of concept, showing that people are willing to invest in your product.

- Community building: It helps you build a community of loyal customers and early adopters.

- Flexibility: You can use crowdfunding platforms to raise small amounts of capital from a wide base of individuals.

Platforms like Ketto, Wishberry, and Fueladream are great places to start for Indian startups looking to crowdsource funding.

Final Thoughts

Securing funding for your startup in India is a multi-faceted journey that requires careful planning, strategic positioning, and an understanding of the various funding avenues available to you. Whether it’s through government schemes, venture capital, angel investors, alternative financing, or corporate partnerships, there are plenty of opportunities for startups in 2025. The key to success lies in understanding what investors are looking for, preparing your business for investment, and navigating the funding landscape with confidence and persistence.

Remember, the road to success is rarely linear. But with the right resources, determination, and strategies, you can overcome challenges and unlock the capital needed to take your startup to the next level.

Good luck, and here’s to building the future of India’s startup ecosystem! 🚀

Call to Action (CTA) for Kartafol.com

Now that you’ve explored the top funding options for Indian startups in 2025, it’s time to take the next step and turn your startup dreams into reality! Whether you’re navigating through government schemes, seeking venture capital, or exploring alternative financing methods, the right strategy and support can make all the difference.

At Kartafol.com, we specialize in helping startups and entrepreneurs like you unlock the right funding opportunities and scale successfully. With our expertise in startup consulting, business strategy, and funding navigation, we are committed to helping you connect with the right investors, secure the capital you need, and accelerate your business growth.

Don’t let the complexities of funding hold you back. Reach out to Kartafol.com today, and let us guide you through the funding maze to the capital that will fuel your startup’s success!

👉 Get in touch with us today at Kartafol.com and unlock your startup’s funding potential! 🚀